The 35-year-old confirmed the. Transfers of shares in an unlisted Malaysian company attract stamp duty at the rate of 03 percent of the value of shares transferred.

The Pros And Cons Of Freehold And Leasehold Property

Total Asset Intangible Asset Total Liability NTA per share.

. Information to include in the form are. Before shares can be transferred the shareholder must inform the company director. Section 109 of CA 2016 applies if the right to shares is transmitted.

Form 32A Share Transfer Form click here to see Actual Form Boards Resolution Approval from the Board of Directors to accept the transfer of shares. All transfer of shares are subject to approval from the Board of Directors. The section states that subject to other written laws any shareholder may transfer all or any of his shares in the company by a duly executed and stamped instrument of transfer and shall lodge the transfer with the company.

Details of the transferors and transferees Number of transferred shares. The Share Transfer Form Form 32A need to be witnessed by someone not wife or husband The shareholders need to pay stamp duty for the shares transfer The stamping on Form 32A will be done at any LHDN office. Section 105 1 of the Companies Act 2016 required any shareholder or debenture holder may transfer all or any of his shares or debentures in the company by a duly executed and stamped instrument of transfer and shall lodge the transfer with the company.

A transfer of shares is prescribed under section 1051 of CA 2016. The transfer of shares will attract stamp duty at the rate of 03 on the consideration paid or market value of the shares whichever is the higher. Based on the revised guidelines issued by the IRBs Stamp Duty Unit on 23 June 2020 effective 1 March 2020 the value of shares transferred for stamp duty purposes is the value of the net tangible assets or actual sale consideration.

If the acquisition of shares is in connection with a scheme of amalgamation. As of July 2019 the rates of these stamp duties are set as follows. If the limitation period relating to paragraph 3 of the purchase contract is not specified the legal limitation period applies.

Its tax time again which means a couple of things if you trade shares in Malaysia. Method 1 Net Tangible Asset NTA Formula. For that once the directors had made up their mind in shares transfer.

The new PSG coach brought Kalimuendo on the clubs PSGs tour of Japan recently and he impressed with goals against Urawa Reds and Kawasaki. Procedures to Transfer of Shares of Malaysian Company. Stamp duty for transfer of shares Malaysia.

The stamp duty payable is therefore calculated based on par value ie. In order to transfer shares in a sdn bhd company from one person to another person in Malaysia the following documents are needed to complete the shares transfer. Value of shares transferred RM091 x 150000 RM136500 C Sale consideration RM75000 A comparison between Par Value NTA and sale consideration shows that the value of shares based on par value is the highest.

However stamp duty relief is available for the following circumstances subject to meeting the pre-requisite conditions. Value of transferred shares. Ringgit Consideration Sum In Malaysian Ringgit RM 8.

Finally the Form 32A will be. In consideration of the sum herein mentioned IWe the Transferor hereby transfer to the Transferee the securities referred to in paragraphs 1 and 2 hereof and IWe the Transferee hereby accept the transfer of the said securities. Kasper Schmeichel has shared a thread of his favourite memories as a Leicester player after completing a transfer to Nice.

Consideration Sum in words. Depending on how often you trade shares and how the Inland Revenue Board Of Malaysia IRBM classifies you you might need to pay tax on the profits or gains youve made or you could be eligible for a tax exemption. Stamp duty is a form of real estate transfer tax payable by the purchaser on instruments for the transfer of shares in a company a company and assets.

Duty of secretary to enter issuance and transfer of shares particulars in the register of members Both the 2019 and 2020 Guidelines reiterate that pursuant to Section 102 of the CA 2016 the company secretary is responsible for ensuring that all the particulars pertaining to the issuance and transfer of shares are entered into the register of members. Then they will need to inform the company secretary for proceedings of work. On sale of any stock shares or marketable securities to be computed on the price or value thereof on the date of transfer whichever is the greater For every RM1000 or fractional part of RM1000 RM300.

For shares transfer stamp duty will be calculated by 1 by LHDN and upon completing the process the authority LHDN will be generating a stamping certificate as a proof or cleared payment. Once the director acknowledges the transfer the shareholder is required to complete Form 32A.

Jtb Malaysia Joins Japan Travel Fair In Starling Mall Malaysian Foodie

Latest Market Research Reports On Top Industries Aarkstore Com Retail Banking Banking Marketing

Rasa Malaysia Giovanni S Shrimp Scampi Copycat Recipe Couldn T Navigate The Website Through All The Pop Recipes Shrimp Recipes For Dinner Shrimp Scampi Recipe

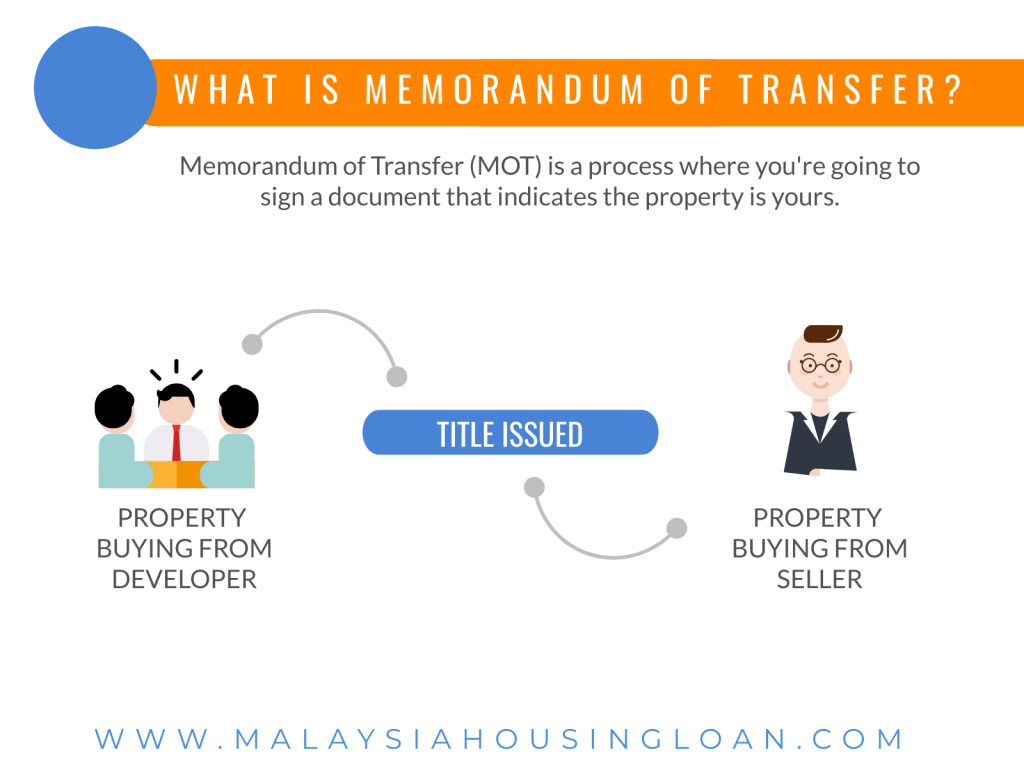

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

1 Nov 2018 Budgeting Inheritance Tax Finance

The World S Largest Manufacturer Of Glove

The World S Largest Manufacturer Of Glove

How Do You Legally Transfer Property To Someone Else In Asklegal My

Baloy Member Mart Newest Outlet At Kota Damansara Selangor Baloy Com My

High Speed Gold Plated Plug Flat Hd Connector Monitor 1 4v 30cm 1ft Flat Hdmi Cable Line For Ipad Tv Projector Hdmi Cables Hdmi High Speed

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

Craft Tip Use Fabric Crayons To Transfer And Duplicate Patterns The Zen Of Making Sewing Techniques Sewing Hacks Sewing Tutorials

Malaysia Transmission Of Shares Universal Succession Conventus Law

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

10 Things Nri Should Know About Portfolio Investment Scheme Pis Nri Saving And Investment Tips Investing Investment Tips Savings And Investment

Form 32a Share Transfer Form Company Registration In Malaysia